Apple biraz önce 2011 yılının üçüncü çeyreğine ilişkin raporları açıkladı. Şirket çeyreği 28.57 Milyar dolarlık yeni bir rekor ile kapattı. Üstelik satış patlaması yaşanan tatil sezonu olmadığı halde… Bu gelirin 7.31 Milyar doları ise net kar!

Apple yılın üçüncü çeyreğinde, sıkı durun 20.34 milyon adet iPhone (%142 artış), 9.25 milyon adet iPad (%142 artış), 4.95 milyon adet Mac (%14 artış) satışı gerçekleştirdi. Artışlar geçen yılın aynı dönemine göre hesaplanmıştır. Satışı azalan tek ürün, iPhone’un yerleşik iPod ile birlikte gelmesi nedeniyle 7.54 milyon adet iPod’da gerçekleşti. Ürün satışı %20 azaldı.

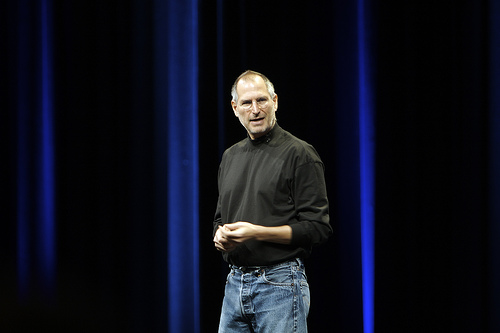

Apple CEO’su Steve Jobs “Bundan sonra, iOS 5 ve iCloud’u sonbaharda kullanıcılar ile tanıştırmak için odaklandık, heyecanlıyız” dedi.

Rapor hakkında ekstra bilgiye şirketin PR sayfasından (www.apple.com/pr) erişilebilir.

Bu arada değinmeden edemeyeceğim. Mac OS X Lion ‘ın 20 Temmuz’da yayınlanacağı resmen açıklandı….

Meraklılar için:

| Three Months Ended | Nine Months Ended | ||||||||||||||||

| June 25, 2011 |

June 26,2010 | June 25, 2011 |

June 26,2010 | ||||||||||||||

| Net sales | $ | 28,571 | $ | 15,700 | $ | 79,979 | $ | 44,882 | |||||||||

| Cost of sales (1) | 16,649 | 9,564 | 47,541 | 26,710 | |||||||||||||

| Gross margin | 11,922 | 6,136 | 32,438 | 18,172 | |||||||||||||

| Operating expenses: | |||||||||||||||||

| Research and development (1) | 628 | 464 | 1,784 | 1,288 | |||||||||||||

| Selling, general and administrative (1) | 1,915 | 1,438 | 5,574 | 3,946 | |||||||||||||

| Total operating expenses | 2,543 | 1,902 | 7,358 | 5,234 | |||||||||||||

| Operating income | 9,379 | 4,234 | 25,080 | 12,938 | |||||||||||||

| Other income and expense | 172 | 58 | 334 | 141 | |||||||||||||

| Income before provision for income taxes | 9,551 | 4,292 | 25,414 | 13,079 | |||||||||||||

| Provision for income taxes | 2,243 | 1,039 | 6,115 | 3,374 | |||||||||||||

| Net income | $ | 7,308 | $ | 3,253 | $ | 19,299 | $ | 9,705 | |||||||||

| Earnings per common share: | |||||||||||||||||

| Basic | $ | 7.89 | $ | 3.57 | $ | 20.91 | $ | 10.69 | |||||||||

| Diluted | $ | 7.79 | $ | 3.51 | $ | 20.63 | $ | 10.51 | |||||||||

| Shares used in computing earnings per share: | |||||||||||||||||

| Basic | 926,108 | 912,197 | 922,917 | 907,762 | |||||||||||||

| Diluted | 937,810 | 927,361 | 935,688 | 923,341 | |||||||||||||

| (1) Includes stock-based compensation expense as follows: | |||||||||||||||||

| Cost of sales | $ | 52 | $ | 38 | $ | 155 | $ | 112 | |||||||||

| Research and development | $ | 119 | $ | 80 | $ | 336 | $ | 240 | |||||||||

| Selling, general and administrative | $ | 113 | $ | 101 | $ | 379 | $ | 303 | |||||||||

| Apple Inc.UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS(In millions, except share amounts) | ||||||||

| June 25, 2011 | September 25, 2010 | |||||||

| ASSETS: | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 12,091 | $ | 11,261 | ||||

| Short-term marketable securities | 16,304 | 14,359 | ||||||

| Accounts receivable, less allowances of $55 in each period | 6,102 | 5,510 | ||||||

| Inventories | 889 | 1,051 | ||||||

| Deferred tax assets | 1,892 | 1,636 | ||||||

| Vendor non-trade receivables | 5,369 | 4,414 | ||||||

| Other current assets | 4,251 | 3,447 | ||||||

| Total current assets | 46,898 | 41,678 | ||||||

| Long-term marketable securities | 47,761 | 25,391 | ||||||

| Property, plant and equipment, net | 6,749 | 4,768 | ||||||

| Goodwill | 741 | 741 | ||||||

| Acquired intangible assets, net | 1,169 | 342 | ||||||

| Other assets | 3,440 | 2,263 | ||||||

| Total assets | $ | 106,758 | $ | 75,183 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY: | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 15,270 | $ | 12,015 | ||||

| Accrued expenses | 7,597 | 5,723 | ||||||

| Deferred revenue | 3,992 | 2,984 | ||||||

| Total current liabilities | 26,859 | 20,722 | ||||||

| Deferred revenue – non-current | 1,407 | 1,139 | ||||||

| Other non-current liabilities | 9,149 | 5,531 | ||||||

| Total liabilities | 37,415 | 27,392 | ||||||

| Commitments and contingencies | ||||||||

| Shareholders’ equity: | ||||||||

| Common stock, no par value; 1,800,000,000 shares authorized; 926,903,779 and 915,970,050 shares issued and outstanding, respectively |

12,715 | 10,668 | ||||||

| Retained earnings | 56,239 | 37,169 | ||||||

| Accumulated other comprehensive income/(loss) | 389 | (46 | ) | |||||

| Total shareholders’ equity | 69,343 | 47,791 | ||||||

| Total liabilities and shareholders’ equity | $ | 106,758 | $ | 75,183 | ||||

| Apple Inc.UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS(In millions) | |||||||

| Nine Months Ended | |||||||

| June 25, 2011 | June 26, 2010 | ||||||

| Cash and cash equivalents, beginning of the period | $ | 11,261 | $ | 5,263 | |||

| Operating activities: | |||||||

| Net income | 19,299 | 9,705 | |||||

| Adjustments to reconcile net income to cash generated by operating activities: | |||||||

| Depreciation, amortization and accretion | 1,271 | 698 | |||||

| Stock-based compensation expense | 870 | 655 | |||||

| Deferred income tax expense | 2,232 | 1,298 | |||||

| Changes in operating assets and liabilities: | |||||||

| Accounts receivable, net | (592 | ) | (79 | ) | |||

| Inventories | 162 | (487 | ) | ||||

| Vendor non-trade receivables | (955 | ) | (1,256 | ) | |||

| Other current and non-current assets | (1,551 | ) | (1,001 | ) | |||

| Accounts payable | 2,480 | 2,812 | |||||

| Deferred revenue | 1,276 | 806 | |||||

| Other current and non-current liabilities | 2,608 | (239 | ) | ||||

| Cash generated by operating activities | 27,100 | 12,912 | |||||

| Investing activities: | |||||||

| Purchases of marketable securities | (75,133 | ) | (41,318 | ) | |||

| Proceeds from maturities of marketable securities | 16,396 | 19,758 | |||||

| Proceeds from sales of marketable securities | 34,301 | 14,048 | |||||

| Payments made in connection with business acquisitions, net of cash acquired | 0 | (615 | ) | ||||

| Payments for acquisition of property, plant and equipment | (2,615 | ) | (1,245 | ) | |||

| Payments for acquisition of intangible assets | (266 | ) | (63 | ) | |||

| Other | 34 | (36 | ) | ||||

| Cash used in investing activities | (27,283 | ) | (9,471 | ) | |||

| Financing activities: | |||||||

| Proceeds from issuance of common stock | 577 | 733 | |||||

| Excess tax benefits from equity awards | 915 | 652 | |||||

| Taxes paid related to net share settlement of equity awards | (479 | ) | (384 | ) | |||

| Cash generated by financing activities | 1,013 | 1,001 | |||||

| Increase in cash and cash equivalents | 830 | 4,442 | |||||

| Cash and cash equivalents, end of the period | $ | 12,091 | $ | 9,705 | |||

| Supplemental cash flow disclosure: | |||||||

| Cash paid for income taxes, net | $ | 2,563 | $ | 2,657 | |||

| Apple Inc. | |||||||||||||||||||||

| Q3 2011 Unaudited Summary Data | |||||||||||||||||||||

| Q2 2011 | Q3 2010 | Q3 2011 | |||||||||||||||||||

| Sequential Change | Year/Year Change | ||||||||||||||||||||

| Operating Segments | CPUUnits K | Revenue$M | CPUUnits K | Revenue$M | CPUUnits K | Revenue$M | CPU Units | Revenue | CPU Units | Revenue | |||||||||||

| Americas | 1,217 | $9,323 | 1,358 | $6,227 | 1,487 | $10,126 | 22% | 9% | 9% | 63% | |||||||||||

| Europe | 995 | 6,027 | 914 | 4,160 | 922 | 7,098 | – 7% | 18% | 1% | 71% | |||||||||||

| Japan | 155 | 1,383 | 129 | 910 | 150 | 1,510 | – 3% | 9% | 16% | 66% | |||||||||||

| Asia Pacific | 596 | 4,743 | 394 | 1,825 | 620 | 6,332 | 4% | 34% | 57% | 247% | |||||||||||

| Retail | 797 | 3,191 | 677 | 2,578 | 768 | 3,505 | – 4% | 10% | 13% | 36% | |||||||||||

| Total Operating Segments | 3,760 | $24,667 | 3,472 | $15,700 | 3,947 | $28,571 | 5% | 16% | 14% | 82% | |||||||||||

| Sequential Change | Year/Year Change | ||||||||||||||||||||

| Product Summary | Units K | Revenue$M | Units K | Revenue$M | Units K | Revenue$M | Units | Revenue | Units | Revenue | |||||||||||

| Desktops (1) | 1,009 | $1,441 | 1,004 | $1,301 | 1,155 | $1,580 | 14% | 10% | 15% | 21% | |||||||||||

| Portables (2) | 2,751 | 3,535 | 2,468 | 3,098 | 2,792 | 3,525 | 1% | 0% | 13% | 14% | |||||||||||

| Subtotal CPUs | 3,760 | 4,976 | 3,472 | 4,399 | 3,947 | 5,105 | 5% | 3% | 14% | 16% | |||||||||||

| iPod | 9,017 | 1,600 | 9,406 | 1,545 | 7,535 | 1,325 | – 16% | – 17% | – 20% | – 14% | |||||||||||

| Other Music Related Products and Services (3) | 1,634 | 1,214 | 1,571 | – 4% | 29% | ||||||||||||||||

| iPhone and Related Products and Services (4) | 18,647 | 12,298 | 8,398 | 5,334 | 20,338 | 13,311 | 9% | 8% | 142% | 150% | |||||||||||

| iPad and Related Products and Services (5) | 4,694 | 2,836 | 3,270 | 2,166 | 9,246 | 6,046 | 97% | 113% | 183% | 179% | |||||||||||

| Peripherals and Other Hardware (6) | 580 | 396 | 517 | – 11% | 31% | ||||||||||||||||

| Software, Service and Other Sales (7) | 743 | 646 | 696 | – 6% | 8% | ||||||||||||||||

| Total Apple | $24,667 | $15,700 | $28,571 | 16% | 82% | ||||||||||||||||

| (1) | Includes iMac, Mac mini, Mac Pro and Xserve product lines. | ||||||||||||||||||||

| (2) | Includes MacBook, MacBook Air and MacBook Pro product lines. | ||||||||||||||||||||

| (3) | Includes sales from the iTunes Store, App Store, and iBookstore in addition to sales of iPod services and Apple-branded and third-party iPod accessories. | ||||||||||||||||||||

| (4) | Includes revenue recognized from iPhone sales, carrier agreements, services, and Apple-branded and third-party iPhone accessories. | ||||||||||||||||||||

| (5) | Includes revenue recognized from iPad sales, services, and Apple-branded and third-party iPad accessories. | ||||||||||||||||||||

| (6) | Includes sales of displays, wireless connectivity and networking solutions, and other hardware accessories. | ||||||||||||||||||||

| (7) | Includes sales from the Mac App Store in addition to sales of other Apple-branded and third-party Mac software and Mac and Internet services. | ||||||||||||||||||||

| K = Units in thousands $M = Amounts in millions | |||||||||||||||||||||

En olacağı buydu :) ayrıca 187.51 dolara mal olan iPhone 4 (GSM verizon için yapılan daha ucuz) kac dolar ve Euro’ya satılıyor :) tabi su gercegi de unutmamak gerek ürünler kaliteli ve çok başarılı.

NOT: iOS 5 Beta 3’ten nefret ediyorum. Su yazıyı safari sürekli çöktüğü için altıncı demememde yazıyorum (iPad)